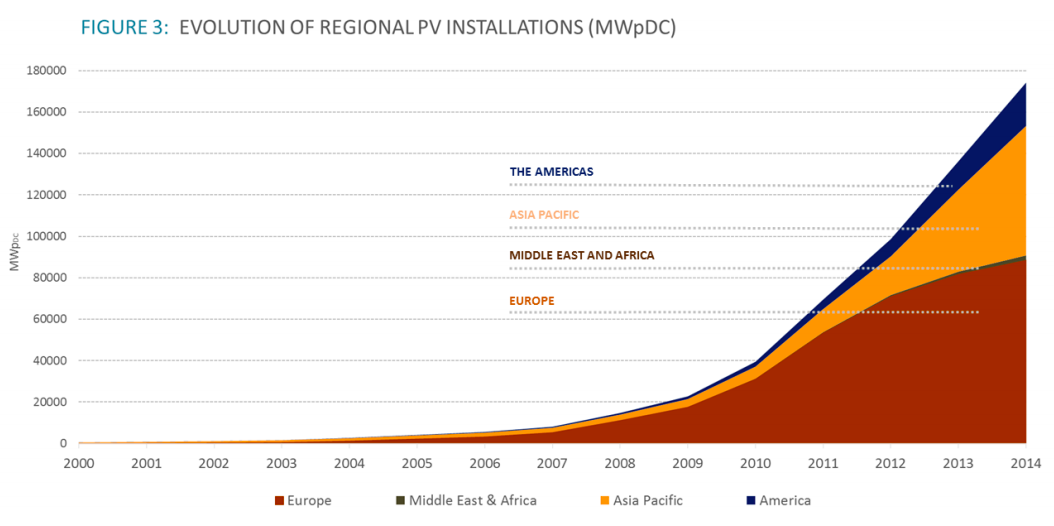

I don’t know if you’ve noticed the increasing number of solar panels in fields and on rooftops, but I sure have. Cities, states, and nations are vowing to become carbon neutral in the next 30 to 40 years. The alternative energy takeover has a timeline chartered for it. Despite the U.S. government’s agenda to revive fossil fuels and instate solar tariffs, solar panel installations have grown exponentially worldwide since commercial production began in the late 20th century.

However, the current growth of solar is nominal when scaled to the U.S. economy. Now is the time to invest in cheap U.S. solar company stocks before prices rise drastically. As an alternative energy investor and conservation master’s student, I am confident that the rise of the U.S. solar industry is just beyond the horizon.

In the U.S., the cost of creating solar energy in modernized plants is $85 per megawatt-hour (MWh). This is competitively priced compared to wind ($64/MWh), coal ($123/MWh), and natural gas ($70-$100/MWh). Additionally, these figures do not include the environmental costs of fossil fuels.

The U.S. solar industry has the most employees of any sector of energy by twofold at a staggering 373,000 employees. Oddly enough, solar energy only makes up 1 percent of utility usage in the United States. Small but mighty, the annual growth rate of the solar industry in the U.S. has averaged a blistering pace of 68 percent per year over the last decade. These eye-opening statistics are indicators that solar manufacturers are ramping up production of panels because of rising demand.

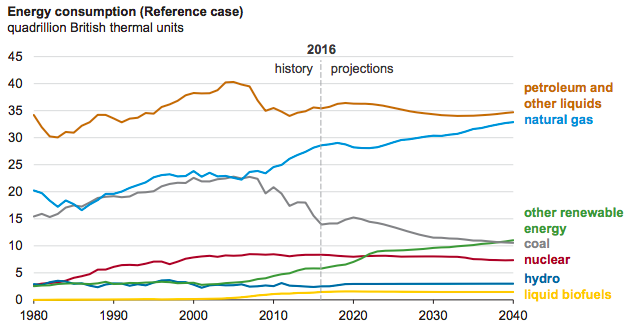

Natural gas is alternative energy’s greatest competitor; it has replaced much of the coal energy share because it is cheap to produce and can be used to generate energy at any time. Wind and solar technologies have the disadvantage of not being able to produce energy constantly without the necessary environmental conditions and therefore require storing energy from peak hours for future use. This is why the U.S. still has a dependence on natural gas.

If alternative energies were America’s primary source of energy, then the current energy storage infrastructure would be incapable of providing the enormous amount of storage space necessary to house the dynamic energy flows of alternative energy. Despite this speedbump, energy storage installation forecasts are charted to grow exponentially through 2022.

The lack of energy storage infrastructure needed to make alternative energy the primary U.S. energy source right now is evident, but a solar revolution has started at the homeowner level. Home solar panel systems are becoming more affordable every year. Depending on the size of the residence, solar panels and an energy storage battery system cost between $20,000 and $30,000 and last 20 to 25 years. The setup will eventually pay for itself and make the homeowner money. A social diffusion study done by Cambridge University proved that if your neighbors install solar panels, then you are more likely to buy a panel system yourself. The more solar panels you and I see every day on our daily commute is a key indicator that homeowners are buying home solar panel systems.

Solar energy is on the brink of becoming the most affordable and efficient energy source in the United States. U.S. solar stocks, like SunRun, are near record lows and are just beginning to experience an upswing. If the exponential growth of the solar sector continues, alternative energy will knock off natural gas from the top of the U.S. energy share in a matter of years. Many U.S. energy companies are surprised with how quickly the U.S. is transitioning to alternative energy, reinforcing my hypothesis. Speculative investment in the U.S. solar industry could have a major return and simultaneously help the environment.

I firmly believe that alternative energy is only a few years away from challenging natural gas at the top of the U.S. utility totem pole. The solar revolution has started at a homeowner level and will soon begin at a utility scale as solar equipment prices continue to fall. Meanwhile, natural gas will only get more expensive in the years to follow because unlike the sun, it is finite. The U.S. is at an energy crossroads. Invest in the U.S. solar industry now, before the impending alternative energy revolution drives up stock prices. The sun is setting on nonrenewable energy and just rising on solar energy.

Disclaimer: The views and opinions expressed here are those of the author and do not necessarily reflect the editorial position of The Globe Post.