European stock markets fell Thursday as economic strains and a drastic downturn in Asia spooked investors, but Wall Street managed to put a halt on its sharp fall seen the previous day, the worst since February.

Mounting worries over high interest rates and trade battles, although hardly new, have reached boiling point, triggering the global reversal seen in global markets, analysts said.

U.S. President Donald Trump blamed “crazy” policies of the Federal Reserve for contributing to financial market turmoil, although a White House spokesman said Thursday he was not trying to dictate Fed policy.

Following sharp falls of around four to six percent on Asia’s main stock markets, Europe mostly saw losses of up to one percent on the main indices Thursday.

On Wall Street, the Dow was testing positive territory shortly after a weaker opening, as did the S&P 500 and Nasdaq indices, before slipping back. Analysts didn’t want to call the market’s direction for the rest of the day.

“Global sentiment remains skittish amid the recent rise in global bond yields, led by Treasuries, as well as concerns about the Fed tightening policy too much despite rising risks,” said Charles Schwab analysts.

Voting with Feet

“In the absence of a specific trigger, investors are currently voting with their feet due to mounting concerns around trade tensions and the impact on global growth, higher interest rates in the US, and a potential rotation away from equities due to rising bond yields,” said Richard Hunter, head of markets at Interactive Investor.

U.S. Treasury Secretary Steven Mnuchin, meanwhile, said that Wall Street’s rout was a natural correction and not caused by any particular factors.

He spoke after International Monetary Fund chief Christine Lagarde defended central bank rate hikes in a veiled rebuke to Trump.

“It is clearly a necessary development for those economies that are showing much-improved growth, inflation that is picking up… unemployment that is extremely low,” she told a press briefing in Bali, host to annual meetings of the IMF and World Bank this week.

"The economy's not quite as strong as the number indicated," says global investor Barry Sternlicht. https://t.co/z9OijSUiqQ

— CNBC (@CNBC) October 11, 2018

All Bets Off

The IMF on Tuesday cut its global GDP growth forecast by 0.2 percentage points to 3.7 percent for both 2018 and 2019, citing economic uncertainties.

“All bets are off,” warned Stephen Innes, head of Asia-Pacific trading at OANDA, adding that markets were “fraught with peril”.

Among Asia’s biggest stock market losers Thursday were Shanghai and Taipei, closing down 5.2 and 6.3 percent respectively. Chinese stock markets plunged to their lowest levels in four years.

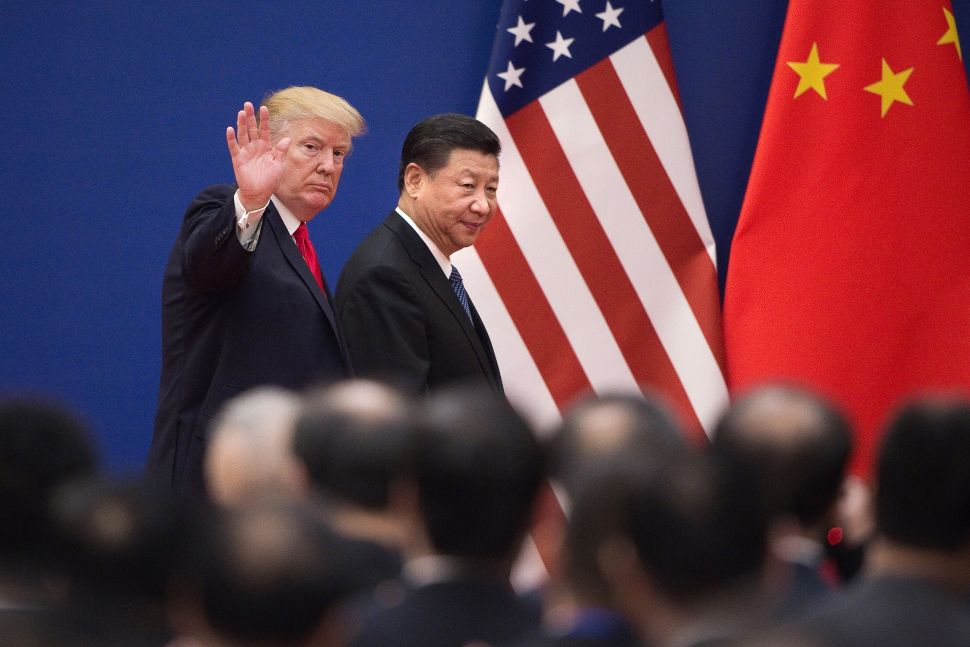

“Interest rate put aside, the Sino-US trade spat is to blame for the October market rout because people are worried the friction would evolve into a political confrontation,” Guangzhou Wanlong Securities said in a research note.

‘Fed Mistake’

Trump’s latest criticism of the Federal Reserve gave investors another headache.

“I think the Fed is making a mistake,” Trump told reporters as he arrived for a campaign rally ahead of the US mid-term elections.

Trump has repeatedly touted Wall Street records as proof of the success of his economic programme.

European markets are struggling also owing to tensions between Brussels and Rome over Italian budget plans that have revived fears about the eurozone. Also simmering are the stalled Brexit negotiations between Britain and the EU.

Germany’s government meanwhile on Thursday slashed its growth forecasts for 2018 and 2019, blaming “a weaker international trade environment” for sapping the export powerhouse.

Key Figures around 1400 GMT

New York – Dow Jones: FLAT at 25,595.57

New York – S&P 500: FLAT at 2,785.60

New York – Nasdaq: UP 0.3 percent at 7,444.64

London – FTSE 100: DOWN 1.2 percent at 7,057.52

Paris – CAC 40: DOWN 0.9 percent at 5,160.79

Frankfurt – DAX 30: DOWN 0.4 percent at 11,654.70

EURO STOXX 50: DOWN 0.7 percent at 3,245.27

Hong Kong – Hang Seng: DOWN 3.5 percent at 25,266.37 (close)

Shanghai – Composite: DOWN 5.2 percent at 2,583.46 (close)

Tokyo – Nikkei 225: DOWN 3.9 percent at 22,590.86 (close)

Euro/dollar: UP at $1.1558 from $1.1523 at 2100 GMT on Wednesday

Pound/dollar: DOWN at $1.3217 from $1.3222

Dollar/yen: DOWN at 112.49 from 112.35 yen

Oil – Brent Crude: DOWN $1.39 at $81.70 per barrel

Oil – West Texas Intermediate: DOWN 98 cents at $72.19 per barrel