An economic recession occurred in every single decade since 1795, and the coronavirus could give us the dreaded “R-word” in the decade ending in 2020. Historically, economic growth does not die of old age but is instead “murdered” by external shocks. With the coronavirus crisis, the global economy now faces both supply and demand shocks and panic in the financial market.

In an effort to stop the disease’s spread, China applied draconian and authoritarian measures to contain the virus and has reported some promising results. Korea and Singapore, where the citizens tend to accept the government’s paternalistic role, applied firm hands to identify, track, test, and quarantine suspects.

Meanwhile, in Western societies, where freedom and individualism are cherished and expected, such a heavy-handed approach won’t be accepted. However, there is a price to pay. Testing has been woefully inadequate, and there are many unknowingly infected people walking around the streets, unwittingly spreading the virus and hurting the economy.

Global Recession in the Making

In the United States, the cat is out of the bag. In hindsight, all travel from China should have been halted immediately. The U.S. government travel restrictions were implemented far too late. The virus needs no passports, and the window of opportunity to prevent a pandemic quickly came and went.

Chinese researchers found that every single day of earlier response could have reduced the rate of infection by 2.2 percent. They discovered that if the Wuhan travel ban had been imposed just three days earlier, infections would have been reduced by 47 percent.

One potential consequence of the lax monitoring of the disease is a global recession. We won’t know for sure until a year from now, but there is a good chance that the NBER – the organization responsible for calling recession timings – will say a recession started during the first half of 2020.

The pandemic has both supply-side and demand-side shocks. On the supply side, there have been numerous examples of production cutbacks, including from Apple, Cummins Engines, and Hyundai Automobiles. On the demand side, mounting fears are holding back consumers and businesses from spending. Meetings are canceled, shopping centers are empty, and factories have idled.

Lowering Interest Rates

For the U.S. economy, the demand-side effect outside of China is more important. For the S&P 500 companies, only 2 percent of sales came from China, 30 percent from overseas, and 70 percent from domestic demand. With the coronavirus spreading throughout the world, falling corporate sales and the corresponding economic impact will depress growth.

The Federal Reserve already cut the interest rate close to zero and announced other measures to boost liquidity in the financial markets. Some argue that this pandemic is a supply shock and monetary easing is not effective. However, the pandemic also creates a demand shock. Monetary policy is more suited to cushion the demand shock.

Even though the Federal Reserve indicated that it will engage in currency swaps with other central banks, it is not enough. The Federal Reserve and other central banks should consider a coordinated monetary response to this global disaster. Central banks can address the psychological virus in the financial market by making sure that there are no liquidity shortages.

Unfortunately, lower interest rate rates won’t persuade the spooked consumers to return to restaurants and theatres. Further, the U.S. central bank is almost out of ammunition and could be impotent.

Need for Leadership

Money is not the only answer to assuage the panic in the financial market and fear among consumers and businesses. The White House and Congress have agreed to a stimulus plan, but it will take time to ease the panic in the financial markets and fear among independent small businesses.

In addition to money, this crisis requires strong leadership. The public must believe that Washington is taking steps to swing the economy in the right direction. The 1930s Great Depression started under President Herbert Hoover, but Franklin D. Roosevelt ended it. The fact that he was able to win the confidence of the people was the deciding factor in turning the tide.

A comforting factor today is that the economy was healthy before the pandemic broke out and has some cushion to absorb the shock from the disease. The banking system is well capitalized, and the panic in the stock market is unlikely to spread to the banking sector.

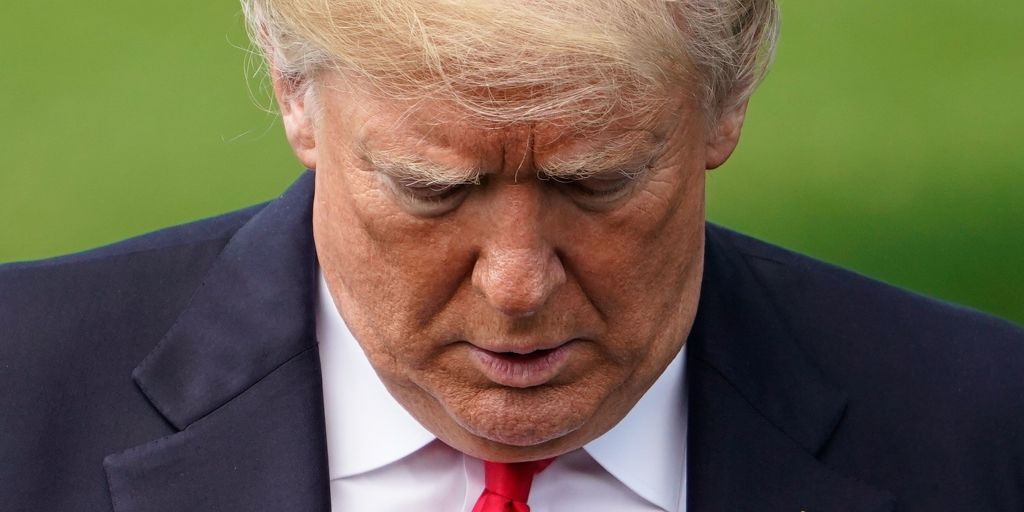

However, President Donald Trump needs to convince consumers, businesses, and financial markets that his leadership will end the panic. Declaring a national emergency was a step in the right direction, but he needs a bazooka. More stimulus measures are required to combat the effects of the pandemic on the economy.

Disclaimer: The views and opinions expressed here are those of the author and do not necessarily reflect the editorial position of The Globe Post.