Two trillion dollars of relief funding is on its way. Not necessarily the great elixir we need to save us from this pandemic, but certainly a palliative of sorts to soften the pain for some. Perhaps even more importantly, a show of force and fortitude from a federal government that has been slow from the start in helping us through this brutal storm.

We must all be on notice, however. Regrettably, with this kind of massive government care package in the works, fraud is sure to follow.

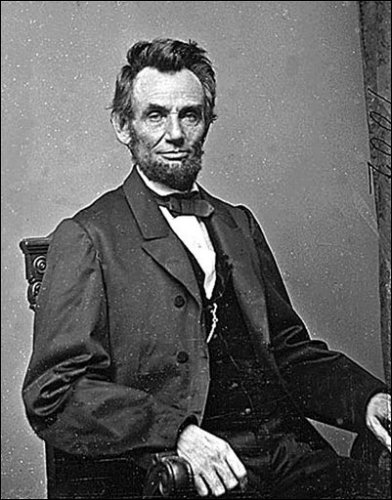

Throughout our history, fraud against the government has been common in times of panic or disaster. As far back as the Civil War, contractors to the Union Army were notorious for trying to sell lame mules as healthy horses, bags of sand as flour, and sawdust as gun powder, among other duplicities. It was this misbehavior that spawned the False Claims Act (FCA), also known as “Lincoln’s Law,” which remains the government’s principal enforcement tool against fraud.

Among its key features is the right it provides whistleblowers to serve as “private attorneys general” and sue these kinds of government scofflaws on behalf of the United States, and share in up to 30 percent of any ultimate recovery. The U.S. treasury recovers billions under the law annually, with most of the cases being brought by whistleblowers.

With its powerful incentives and protections, the FCA has provided the perfect pathway for whistleblowers throughout history to root out fraud against the government in times of crisis. Whistleblowers went after companies trying to defraud New Deal programs at the height of the Great Depression, the U.S. military during the early stages of World War 2, and the U.S. flood insurance program in the aftermath of Hurricane Katrina.

In each of these cases, and during many other national calamities, the government made large financial infusions to soften the blow, and in each of these cases, fraudsters tried to take advantage of the surrounding chaos and uncertainty. And in each of these circumstances, whistleblowers jumped in to expose the wrongdoing.

The coronavirus relief packages will no doubt follow a similar pattern, leading to millions, if not billions, of dollars of fraud against the government.

CARES Act and Fraud

Take the wide expansion of telehealth services, for example. The government has wisely relaxed the strictures of this otherwise highly regulated area of medicine so America’s most vulnerable can see their doctors from home without needless exposure to other patients, who may be carriers of coronavirus.

But this significant diversion of Medicare funding exposes an already fraud-prone area of healthcare to even more risk. A 2018 investigation by the Department of Health and Human Services found that over 30 percent of telehealth procedures did not meet Medicare standards for reimbursement. Another recent action by DOJ revealed a $1.2 billion kickback scheme involving several telehealth companies.

CORONAVIRUS:

President Donald Trump signed a $2.2 trillion economic rescue package Friday, calling the bill much-needed relief for American workers reeling from the economic tumult caused by COVID-19.

Trump Signs Into Law $2T Coronavirus Relief Packagehttps://t.co/mhPzEfJh4p pic.twitter.com/L5NeVzwvpn

— Voice of America (@VOANews) March 27, 2020

The coronaviruses packages also include relief for certain types of business, whether it be in the form of low (or zero) interest loans or direct cash infusions— another desperately needed action. But also one prone to fraud. Indeed, the government – with the help of whistleblowers – routinely goes after businesses that misrepresent themselves as being smaller than they are, or owned by women veterans or minorities to improperly qualify for special government contracts.

These are just two areas of fraud we can expect to see in the coming months as the CARES Act funding begins to flow. Only a small sampling of the panoply of scams and schemes that we can be sure will pop up. Understandably, our primary focus right now should be to fund healthcare and business programs and services to keep Americans as safe as possible and restore our faltering economy as quickly as we can. At the same time, however, we need to be mindful of those that will try to make a profit off of misfortune.

We also need to recognize this cash influx will unlikely be accompanied by a proportionate increase in government resources to go after fraud. The government is already at the brink of what it is able to handle. This makes it even more important for all of us would-be whistleblowers to say something when we see fraudsters trying to profit off these desperate times, just as whistleblowers have always done throughout our darkest days.

Disclaimer: The views and opinions expressed here are those of the author and do not necessarily reflect the editorial position of The Globe Post.