Over the last four decades, major banks and financial institutions have come to play an increasingly dominant role in the global economy.

Whereas economies were once based on the production of goods and services, an ever-increasing amount of economic activity is now concentrated in financial hubs like Wall Street and London.

While this process of financialization has produced some of the strongest stock markets in history in recent decades, it’s also come with serious consequences for ordinary people who don’t sit on corporate boards or own major shares of companies.

Even when times are good, the many have been largely excluded from the success enjoyed by the few. In the United States, the average worker is no better off today than they were 40 years ago, even as they’ve had to face unprecedented inequality, soaring public and private debt, less secure work, and an ever-more volatile, boom or bust economy.

To Grace Blakeley, an economics commentator with the New Statesman and a research fellow at the London-based Institute of Public Policy Research, this model of finance-led growth is both unjust and unsustainable.

Where many see a strong economy today, Blakeley sees not just the early indicators of an inevitable recession, but the “death throes” of an entire economic model that’s crumbling before our eyes.

In her first book, “Stolen: How to Save the World from Financialization,” Blakeley warns of a bleak future for societies on both sides of the Atlantic if the current course is not corrected. But she also offers a hopeful, alternative vision for the years to come and a roadmap for how to get there.

This week, Blakeley sat down with The Globe Post’s Bryan Bowman for a conversation about financialization and why she believes the world must be saved from it.

The following interview has been lightly edited and condensed for length and clarity. You can listen to the full, unedited interview above.

Bowman: The book is called “Stolen: How to Save the World from Financialization.” What exactly is financialization and why do you believe the world need to be saved from it?

Good question. So the kind of technical definition of financialization is the increasing role of financial motives, financial markets, financial actors and institutions in the operation of the national and domestic economy. Basically what that means is bigger banks and bigger investors – people who lend money and those who invest money – playing a much more significant role in all areas of the economy.

So it’s not just about bigger banks doing crazier stuff as we had in the run-up to the financial crisis. It’s actually about the way in which the growth of finance changes the behaviors of other actors in the economy. And I look at the financialization of the corporation, the household, the state, and of the international economy.

The incentives around financialization mean that you get a massive increase in debt levels. You get corporations that end up focusing much more on their shareholders and their creditors than they do on actually making stuff or paying their workers. You get a massive increase in private household borrowing alongside incentives towards individual property ownership rather than collective, shared ownership of things like housing and pensions. And then you get a state that becomes more and more enthralled to the interests of the city of London in the U.K. or Wall Street in the U.S. and less kind of attentive to the needs of ordinary citizens.

Bowman: Where did this model of financialization originate from? Could you give us a sense of the history and the forces that contributed to all of this?

Blakeley: So in the book I chart the emergence of this model from the 1980s onwards. And basically the argument of the book is that all forms of capitalism tend towards crisis, right? In the 1970s we had a crisis of capitalism in the U.S. and in the U.K. There was this decade of stagnation, political turmoil. You had the breakdown of the Bretton Woods system in 1971 which facilitated in many ways the boom in finance that you had later in the 80s.

It was out of that crisis that a bunch of new politicians – Reagan here, Thatcher in the U.K. – came up with this new model that was basically neoliberalism. Neoliberalism as an ideology gives rise to this historical economic model which I call finance-led growth. And they argue for a massive deregulation of the banking system, for privatization, for cracking down on the union movement, for a bunch of stuff that facilitates the growth of the big banks and facilitates the growth of individual investment out of big institutional investors. And this allows those actors to have much more of an influence over all different parts of the economy.

We’re living through a period of systems collapse – living standards are stagnant, institutions are collapsing and the world is burning

There is a way out – but only if working people can come together, take control and build itpic.twitter.com/5Nx8xVt2og

— Grace Blakeley (@graceblakeley) September 13, 2019

So you get a boom on Wall Street. You get an increase in lending. You get the growth of these big international banks. And you get a state that becomes much more thoughtful about what’s going on on Wall Street than perhaps what’s going on on Main Street.

That’s a process that really begins in the 1980s and accelerates through the 90s and early 2000s until you get to the financial crisis. And the argument in the book is that that wasn’t just a banking crisis, it was the collapse of an entire economic model. So now we’re living in a similar crisis moment as the one we had in the 70s where the old models creaking. But we haven’t quite figured out what we want to come next yet.

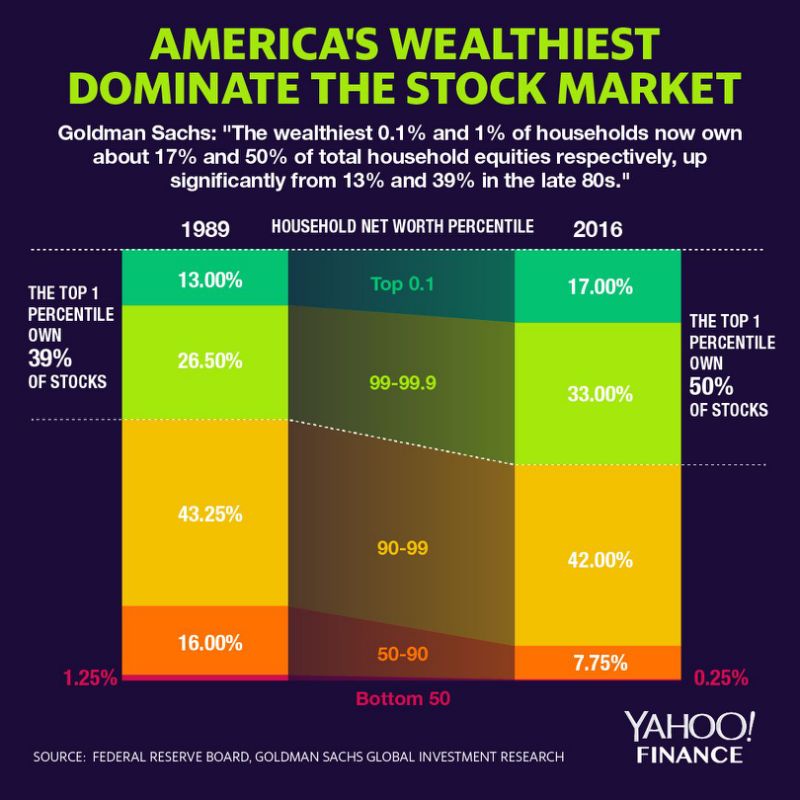

Bowman: Inequality has reached extreme heights in the U.S. and the U.K. in recent decades. And you describe financialization as being based on a kind of trickle-up economics that not only excludes ordinary people from reaping the gains of the system, but even comes directly at their expense. So what are some of the particular ways in which financialization has driven wealth upwards and worsened inequality?

Blakeley: The logic of financialization is like logic of like rent extraction. So economic rents are all kinds of payments to the owners of a resource that don’t generate anything productive.

So usually if I’m buying something from a corporation – I’m buying a bottle of water off them – they take the money, they use it to pay the costs, and if there’s some left over, they reinvest in production so that they can create more water bottles. Whereas the logic of rent extraction is the payment of money by ordinary people to an individual or corporation without them using the returns from that to generate productive investment and growth.

A good example of this is money that renters pay to their landlords because obviously landlords cannot use the returns they receive in rent to create new land. There’s only a certain amount of land in existence and often land and particularly valuable places is monopolized by a couple of big landlords. So they just use that power over the fact that they own the land to extract resources up to themselves.

The same can be said of the big banks. They charge a lot of money in interest for the creation of credit, which is something that they are able to do ad infinitum. So they’re charging for a service that doesn’t cost them anything but that they have a monopoly on because the state gives them the right to create money to issue credit.

So really this idea of economic rents is the idea of a small number of people controlling the resources that everyone else needs to survive, to produce things. And they extract returns that are completely disproportionate to the value that these people create in the production process and therefore are sucking wealth up from the bottom and potentially creating lots of problems in the system. When people at the bottom have lower incomes and less money to spend in the economy, that ends up raising all sorts of crises.

Bowman: A lot of people, at least here in the United States, seem to believe that the economy right now is very strong. But as you alluded to earlier you view this system of financialization as crumbling. Why do you think it’s so unsustainable? Why can’t we carry on like this?

Blakeley: Well the U.S. economy is actually in many ways worse off than some of the other ones that I analyzed in the book. You’ve had several decades of effective wage stagnation in terms of purchasing power parity – the amount that your wages are able to buy. The average U.S. worker is as badly off today as they were in 1978, which is astonishing.

You have low levels of investment in fixed capital, which means businesses aren’t really investing in producing stuff. They’re more likely to be putting their money into financial markets, into mergers and acquisitions, buying back their own shares, basically boosting their share prices rather than actually putting that money into production. There’s a bunch of quite significant problems with the form of capitalism that you have in America basically.

Investment in the U.S. now is kind of slowing down after it peaked because of the Trump tax cuts. Much of the investment that’s taken place recently hasn’t been productive, yet corporations have taken out huge amounts of debt in order to do unproductive investment. Which means that they’re really quite fragile at the moment. A lot of people are talking about the big problem of the corporate debt bubble in the U.S. and what’s going to happen when profits start to fall and that debt burden becomes less sustainable.

The U.S. has had, since the 80s, very high levels of household debt. That’s still a really big problem. In terms of government investment, it’s massively skewed towards stuff that doesn’t particularly help the economy or does that in ways that aren’t really sustainable over the long run. So massive amounts of spending on the military, which is a massive contributor to climate change. It’s kind of the antithesis of what would be the idea at the heart of something like the Green New Deal.

The combination of all these things, combined with a bunch of other fragilities in the financial system and uncertainty around monetary policy, it’s not a situation that we’ve been ever really before in the past. And then there’s the climate crisis. You’re already starting to see more extreme weather events and declining crop yields, problems with agriculture, all this sort of stuff that is going to have a severe impact on the economy as time goes on.

So there really is a sense of urgency around dealing with these problems. It might not be the case that a lot of people think, ‘oh I’m really badly off right now.’ But things are going to get worse. There’s a recession just around the corner. And if you’ve got a lot of debt, if you’re leasing your car, you’ve got a big mortgage, your wages aren’t going to go up, you might lose your job, that’s potentially quite a big problem. I don’t think it’s necessarily the case that things are as bad as they could be now. But things are gonna get worse.

Bowman: Early in the book, you write about the post World War II period that’s often referred to as the “golden age of capitalism.” Here in the U.S., there is a bit of divide on the left between those like Elizabeth Warren who believe capitalism can be reformed and sort of saved from itself, and then those like Bernie Sanders who believe we need to move on from capitalism entirely. I know you’re sort of part of that latter camp. Why is that? Why can’t we recreate the golden age of capitalism now?

Blakeley: Really good question. I mean the golden age of capitalism was underpinned by a couple of different things. So first it was underpinned by the international monetary system – Bretton Woods – which was agreed after the Second World War. It basically was associated with constraint on the ability of money to move around the world, countries pegging their currencies to the dollar, the dollar being pegged to gold, and a lot of regulation of the financial sector. It was also dependent upon empire, which we often forget existed up until the 50s and sometimes the 60s and 70s in some parts of the world.

We live in a world today of extremely high capital mobility and a kind of post-imperial, kind of neo-imperial economy in which it would be very difficult to reconstruct those conditions. Now it’s not to say it’s impossible. We do need to have constraints on finance and constraints on capital mobility. But the conditions that allowed for the emergence of those policies without massive conflict don’t exist anymore.

That’s really the theory behind the book. It’s a theory of history that centers class struggle. The battles between labor and capital – between people who live off work and people who live of wealth. The post-war period was a time when labor and the state had a lot of power. Taxes were high. The unions were quite strong. So they were able to impose this model that for a while worked for them.

But as time wore on as capitalism developed as it naturally does, the people with the wealth and power started to pick away at that system and erode it until you got to the 1980s. Then there was a counter-revolution and a reversal to the historical norm for capitalism, which has been one that’s been really extractive.

So I think the problem isn’t that some of the policies that we had in the post-war period weren’t good and we shouldn’t have them again. The question is how do we get that?

I think what people like Warren and many who think, ‘oh all we need to do is change policy to go back to the post-war period,’ don’t get is that to do a lot of the stuff that she would want to do – clamp down on tax avoidance, carve up some of the big tech companies, properly regulate the financial system – you’re going to need to have a lot of struggle. You’re going to have conflicts and often these people’s preference for not wanting to challenge capitalism is basically a preference for not wanting to have conflict.

The problem isn’t necessarily that they aren’t arguing for the right things. It’s that they aren’t quite there in terms of understanding the power that underpins the current system and how you challenge it. And to do that you need a movement.

Bowman: You talk in the book about how these times of crisis are dangerous but also can serve as a great opportunities. If we can’t simply go back in time and recreate the golden age of capitalism, how can we use this opportunity to correct course and what are the stakes if we don’t?

Blakeley: I think we are in quite a furtive political moment. But also as you said one that’s filled with quite a lot of opportunity. Coming into a recession will increase the ease with which we are able to argue for something like a Green New Deal. We will need some sort of stimulus program to deal with the impact of the next recession, which will come at some point in the next couple of years in both the U.S. and the U.K. So centering around a bunch of demands for the Green New Deal could be really transformational.

The Green New Deal means different things to different people. But broadly speaking it’s basically a big program of investment. And it would crucially be directed towards greening the economy over the long run. The traditional idea of a stimulus program is that the government spends both in order to get money circulating again but also to change the direction of the economy into the future.

For example, historically, you had the New Deal where there were all sorts that would get people working but also make the economy work better over the long run. So the idea today would be to have that big program of investment and direct it towards making the economy more sustainable.

So investing in green energy generation, green transport, green technologies and rebalancing our economies away from finance and tech and towards an economic model that facilitates production onshore so that we’re able to meet our needs without having carbon-intensive imports all the time. That rebalances the economy regionally. So you don’t have a couple of like big hubs where will the production takes place and everywhere else is kind of left barren

The more radical suggestions are to combine that with a big program of taxing wealth to pay for it. That’s not something that we’ve really done since the Golden Age of Capitalism. But it’s really really critical because wealth inequality is so high. We also need to think about the banks and how we properly regulate the financial system so that you know it is not directing a bunch of money into activities that we don’t want to happen.

All of that as well as things like a four-day week. With all of that you start getting towards a situation that is much, much more radical than just a big stimulus program. It would massively rebalance power in society away from the people who own this stuff and towards people who work for a living.

If you had a four-day week, if you had proper investment that meant that your rent went down, transport costs went down, you were guaranteed a good job with a good wage, then people are much better able to organize and to demand more of that of their governments.

Historically, that’s often been why governments have been reluctant to do stuff like this even if it would make the economy work better. It’s because it takes power away from the people that they’re supposed to be supporting. So a Green New Deal could potentially be a really significant stepping block on the road to a more democratic, socialized economy.

More on the Subject

Why is the US Economy so Prone to Crashes? An Interview With Economist Richard Wolff