President Donald J. Trump has reportedly been at odds with his military chiefs over the way forward in Afghanistan because he is reluctant to waste more money on a war that the United States risks “not winning.”

Mr. Trump has, in fact, dared to suggest wholesale withdrawal which has worried many officials in the Pentagon and the White House. Hence, members of Mr. Trump’s inner circle have gone casting about for pretexts.

Which is why White House senior leaders and Afghan government officials have tried to seduce Mr. Trump with the notion that the U.S. could exploit Afghanistan’s mineral wealth, which is estimated to be worth some $1 trillion. Last week, the head of the White House initiative, American Elements Founder and CEO Michael Silver, explained to The Globe Post that Afghanistan’s mineral deposits can help the U.S. counter China’s dominance of rare earth materials.

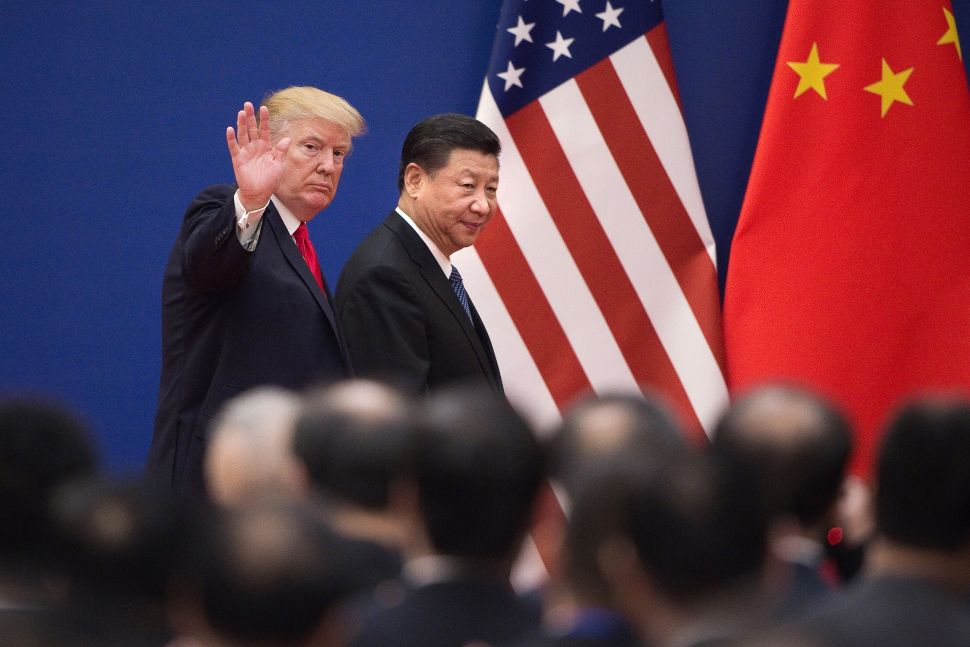

To be fair to Mr. Silver, he was looking at controlling Afghanistan’s minerals as part of a long-term vision to break Beijing’s monopolies on strategic raw materials. However, one would think that within the Afghan government, the White House, and/or private industry, someone would have a general sense as to the costs involved in trying to exploit the trillion-dollar prize. But, apparently, no one has a clue.

Afghan Ministry of Mines and Petroleum spokesperson, Abdul Qadeer Mutfi, told The Globe Post that “speculation abounds” on the value of the materials. The U.S. Geological Survey (USGS) estimate of $908 billion conducted in 2010 is “based on aerial surveys,” and government sources who have repeatedly claimed the country’s mineral worth exceeds $3 trillion, despite lacking data on the cost-side of the equation.

“While geologists agree that Afghanistan’s complex geology is very attractive for prospectors hoping to locate a significant mineral resource, there is little to no information on the proven economic viability of these resources,” Mr. Mutfi said.

And it is not possible, he added, to “foretell” how much it will cost to extract the materials “unless geological, technical and economic analyses are conducted.”

The mining ministry, for its part, Mr. Mufti said, is in the process of implementing reforms to enhance financial viability, initiatives which have received priority attention because the sector is a “potential major contributor to gross foreign exchange.”

Mr. Trump’s initiative certainly is not focused on boosting Afghanistan’s mining capacity, but Mr. Silver said that people need to “get over” the obvious perception of neo-colonial exploitation given the amount the U.S. has invested in Afghanistan compared to rivals like China.

“We [the United States] have given blood and treasure and that makes us evil? China does it all over the world,” Mr. Silver said.

The head of Boston University’s Anthropology Department, Professor Thomas Barfield, raised the issue that it is hard to even estimate costs given the nature of the material involved.

“No one really knows how much is there or what it costs to mine and transport,” the professor told The Globe Post. “Commodity prices vary considerably over time so there is always a speculative aspect to it.”

There is little evidence, actually, that the Afghan government has even benefitted from the mining sector to date. The U.S. Institute of Peace recently published a report highlighting some of the downsides of the burgeoning mining industry.

“Unfortunately, it is generating only negligible taxes and royalties for the Afghan government, largely negating any benefits for national development,” the report stated. “Moreover, such resource exploitation benefits and strengthens the power of warlords, corrupts the government and undermines governance, partly funds the Taliban and reportedly ISIS as well, and fuels both local conflicts and the wider insurgency.”

Adam Smith Institute Fellow Tim Worstall, in a piece for Forbes, boldly estimated that Afghanistan’s mineral deposits were probably worth around nothing.

“The value of a mineral deposit is not the value of the metal once it has been extracted. It’s the value of the metal extracted minus the costs of doing the extraction,” Mr. Worstall said. “And as a good enough rough guess the costs of extracting those minerals in Afghanistan will be higher than the value of the metals once extracted. That is, the deposits have no economic value.”

It is fair to wonder who really benefits from the U.S. exploring mineral opportunities in Afghanistan, given it is utterly impossible to say what the costs are and given the negative consequences suffered by the government and the people of Afghanistan.

Professor Barfield refuted the suggestion, however, that the White House is looking at mineral deposits simply as an excuse to stick around Afghanistan.

“I think the idea is getting a lot of play because it is likely to appeal to Trump and so it is being pushed,” Mr. Barfield said. “It is not a new discovery and is completely tangential to the question of troop levels. Keeping the country from collapsing is more significant than any economic argument.”