Ten years ago this week, on September 15, 2008, the U.S. financial titan Lehman Brothers filed for bankruptcy, triggering a massive fallout that would become known as the Great Recession.

The ramifications were global and long-reaching. Nearly six million people in the United States lost their jobs in the wake of the crisis. Retirement savings vanished. The unemployment rate doubled, maxing out at almost 10 percent. A study from the federal reserve suggests that the average American will lose $70,000 over their lifetime as a result of the crash.

Today, the stock market is booming. The Nasdaq and S&P 500 hit record highs this year while the unemployment rate has reached historic lows. But is the international financial system really any safer now than it was a decade ago?

Despite its strength on paper, experts say the U.S. system remains dangerously vulnerable to future crashes.

Reflecting on the state of the international financial system, Christine Lagarde, managing director of the International Monetary Fund, published an ominous warning last week as we approach the anniversary of Lehman Brothers’ collapse.

“The system is safer, but not safe enough,” Lagarde said.

Risk Taking

Lagarde described a culture on Wall Street that continues to tolerate risky behavior in the name of quick profits.

“One other important area that has not changed much — the area of culture, values, and ethics,” she said. “The financial sector still puts profit now over long-range prudence, short-termism over sustainability.”

Mo Chaudhury, a professor of finance at McGill University, told The Globe Post he shares Lagarde’s concerns.

“What is good for Wall Street and banks is not always good for the general citizenship,” Chaudhury said, explaining that major financial executives are primarily incentivized to promote the interests of their shareholders, even if it means engaging in aggressive and risky trading practices.

Executives claim that their internal risk models are significantly improved since 2008, but Chaudhury said they remain inherently flawed.

“The financial sector still puts profit now over long-range prudence, short-termism over sustainability.”

“The models, after all, are based on assumptions,” he said. “By nature, industry people are reluctant to factor in the most conservative scenario or the most stressful scenario.”

Raising the stakes is the fact that banks continue to grow in size and complexity. Lagarde lamented that there remain banks that are “too-big-to-fail,” making good public sector regulation all the more necessary to prevent another disaster.

Deregulation

In May, Congress repealed parts of the Dodd-Frank Act, a massive Wall Street regulation bill passed after the 2008 collapse aimed at protecting the public from future crises.

Such deregulation, Lagarde said, is dangerous.

“Perhaps most worryingly of all, policymakers are facing substantial pressure from industry to roll back post-crisis regulations.”

Big Bank lobbyists have successfully chipped away at financial regulations, even when Democrats controlled the Senate and White House. Like in 2014, when @Citi slipped an amendment into a spending bill that reversed a key Dodd-Frank provision. #EndCorruptionNow pic.twitter.com/OBopKacax7

— Elizabeth Warren (@SenWarren) August 20, 2018

Lawmakers who supported the repeal have insisted that the changes only affect small and mid-sized banks.

Karen Kunz, a professor of public administration at West Virginia University, said those claims are true but warned that future deregulation efforts are inevitable as financial lobbyists continue to exert pressure on Washington.

Kunz, who is a co-author of “When the Levees Break: Re-visioning Regulation of the Securities Markets,” said that Dodd-Frank was not an adequate solution in itself anyway, calling it “patchwork” and arguing that much broader, systemic reforms are necessary.

“Every time there’s a problem … Congress sort of just comes skipping along afterwards and says, ‘oh, we should do something about this,’” Kunz said. “It’s like closing the barn door after the horses are gone … there’s no forward thinking.”

Regulatory Capture

The power that the financial sector exerts in government is a significant obstacle to regulating the industry in the public interest, Chaudhury and Kunz said.

“[Politicians], in principle, should not owe anything to business. Their primary allegiance should be to the people who elected them,” Chaudhury said. “The problem is, it’s become so expensive to run campaigns that … elected representatives far and wide are falling prey to these lobbying efforts … and become beholden to the special interests.”

Regulatory capture is a concept in political economy that occurs when a government regulatory agency becomes influenced by the interest groups it’s tasked with regulating.

According to Kunz, regulatory capture has been a persistent issue in regulating the financial sector throughout history.

“When you open up the dictionary, you find J.P. Morgan’s picture there,” he said.

“elected representatives far and wide are falling prey to these lobbying efforts … and become beholden to the special interests.”

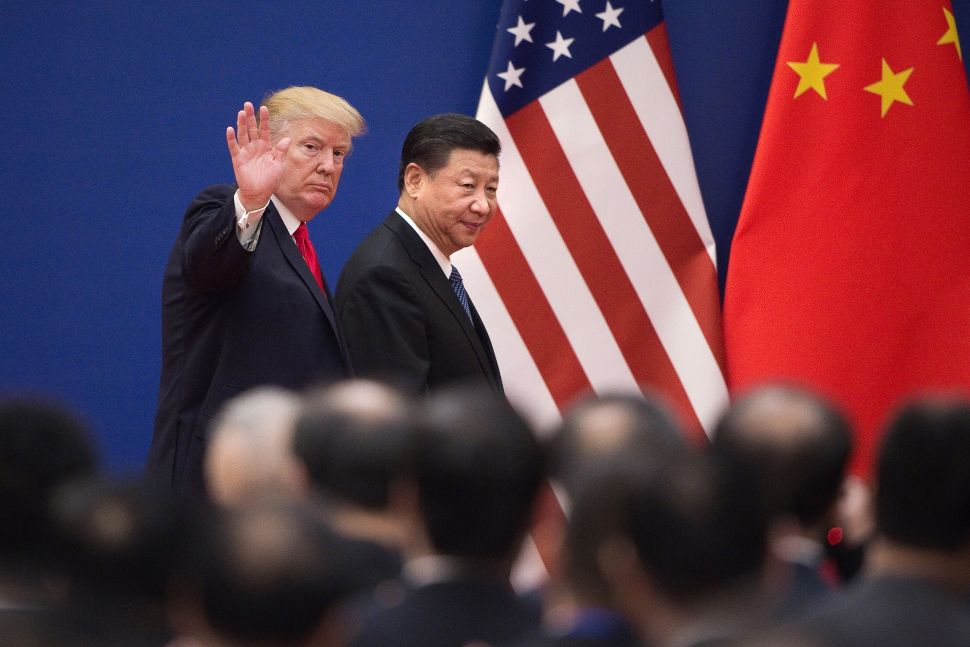

A current example of the issue that Chaudhury cited is the “watering down” of the Consumer Financial Protection Bureau under the Donald Trump administration.

The CFPB was created in the aftermath of the Great Recession and is charged with protecting the American people from predatory behavior from banks.

Trump appointed Mick Mulvaney, a former Congressman with close ties to the banking industry, to serve as its acting director. Since then, the agency has enforced far fewer cases than in previous years. In June, Mulvaney, who referred to the CFPB as “a joke” while in Congress, fired all 25 members of the group’s advisory board.

According to Chaudhury, Mulvaney’s appointment has resulted in “really the destruction of the [CFPB].”

But, as Kunz notes, the issue is much larger than the Trump administration and Mick Mulvaney.

“[Financial regulations] are not effective and they’re not meant to be,” she said. “You have this persistently volatile market because the entire structure requires that it be that. It’s set up to support a volatile market.”

For Chaudhury, the best hope of meaningfully changing the system comes from young people participating in politics. He said the fact that record numbers of young people, particularly young women, are winning elections is evidence that the internet is slowly changing the political landscape.

“These people, as of right now, have no allegiance to big money,” he said. “So, let’s see how, if that happens, the politics and political economy and the regulations change.”