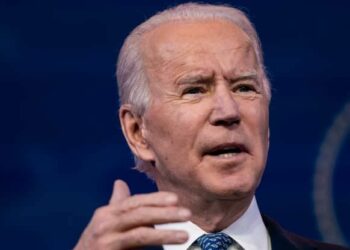

Asian markets slipped Wednesday following a soft lead from Wall Street, while focus turned to the United States where President Joe Biden is expected to unveil his latest multi-trillion-dollar recovery plan for the world’s top economy.

While regional equities have enjoyed a run of buying this week thanks to optimism about the global economic recovery and vaccinations, trading floors remain worried that the rebound will stoke inflation and in turn force central banks to hike interest rates.

The issue has now reached a point where dealers are spooked by good news, with the possibility of more government spending forcing benchmark 10-year US Treasury yields — a gauge of future borrowing costs — to almost double since the turn of the year.

Eyes will be on yields later in the day when Biden is due to announce an infrastructure program that some reports say could run as high as $4 trillion, which would require more borrowing and likely tax hikes.

Axi strategist Stephen Innes also pointed to data Wednesday showing China’s factory activity in March grew much more than expected, reinforcing the view that the Asian powerhouse is well on the road to recovery.

“One would normally expect risk assets to find some legs as China economic data remains steady with the non-manufacturing PMI data exceeding,” he said in a note.

“But we are in such an odd policy paradox right now, globally. Stronger data in China feeds into the (People’s Bank of China) normalizing mantra, while robust data in the States directly leads to higher yields because data beats flame the fires of inflation.

“You are damned if you do, and you are damned if you don’t, so choose your stocks wisely.”

Hong Kong and Shanghai were both lower, while Tokyo was also dragged by financials after it emerged that Mitsubishi UFJ Financial was among the lenders to take a hit from the collapse at Wall Street fund Archegos.

There were also losses in Singapore, Seoul, Mumbai, Taipei, Manila and Jakarta, but Sydney, Bangkok and Wellington rose.

London, Paris and Frankfurt all fell in early trade.

The dollar held gains at a one-year high against the yen as the expected surge in economic growth sees money move out of the safe-haven Japanese unit.

Markets strategist Louis Navellier said markets were growing increasingly fearful that the record low rates and ultra-loose monetary policies that have helped fan a year-long rally were nearing an end.

“Because investors have been so well rewarded in a low-growth, low-rate, low-inflation economy for so long, the notion of this paradigm undergoing such a seismic shift in such a short period has caught much of the investing world flat-footed,” he said.

Markets are also gearing for the release of key US jobs data, which will provide a guide to the state of the economy.

Atlanta Fed President Raphael Bostic said he expected the forecast recovery could mean that the addition of “a million jobs a month could become the standard through the summer”.

Key figures around 0810 GMT

Tokyo – Nikkei 225: DOWN 0.9 percent at 29,178.80 (close)

Hong Kong – Hang Seng: DOWN 0.7 percent at 28,378.35 (close)

Shanghai – Composite: DOWN 0.4 percent at 3,441.91 (close)

London – FTSE 100: DOWN 0.4 percent at 6,747.57

Dollar/yen: UP at 110.72 yen from 110.38 yen at 2250 GMT

Euro/dollar: UP at $1.1734 from $1.1721

Pound/dollar: UP at $1.3749 from $1.3739

Euro/pound: DOWN at 85.34 pence from 85.82 pence

West Texas Intermediate: UP 0.4 percent at $60.80 per barrel

Brent North Sea crude: UP 0.4 percent at $64.38 per barrel

New York – Dow: DOWN 0.3 percent at 33,066.96 (close)