Despite a history of many IMF rescue programs, Argentina once again faces a deepening financial crisis, raising questions about whether the Washington-based lender has done more harm than good in its dealings with Latin America’s third-largest economy.

The International Monetary Fund, which last year approved a record $57 billion loan for Argentina in exchange for sweeping austerity reforms, is in the eye of the storm after President Mauricio Macri suffered a crushing defeat in the August 11 primary elections.

The victory of Peronist candidate Alberto Fernandez put Macri’s reelection in serious jeopardy, and threw financial markets into turmoil, worsening the already grim economic outlook.

Macri requested a loan from the IMF in April 2018 after a run on the currency weakened the peso and worsened the ongoing financial downturn.

Despite early signs the reforms he implemented were stabilizing the economy – and amid the optimistic analysis from the IMF – prices soared and job losses accelerated, sparking outrage and protests in a country with a long, fraught history with the fund.

Argentina has one of the highest inflation rates in the world at 55 percent, while unemployment has risen to 10.1 percent this year and a third of the population lives in poverty.

“Everyone involved really, really should have known better,” Nobel Prize-winning economist Paul Krugman said on Twitter in a thread he titled “Crying for Argentina.”

He accused Macri of shying away from necessary steps for fear of the political blowback, saying he was “unwilling to take the heat for large budget cuts.”

Macri’s reluctance may have been understandable, given the antagonism towards the IMF and its austerity requirements, even though the fund this time has insisted on protecting spending for social programs.

“Macri either couldn’t or wouldn’t bite the bullet,” Krugman tweeted, deploring the increase in foreign debt.

Suffering and Hardship

Mark Weisbrot, an economist at the Washington-based Center for Economic and Policy Research, has a different critique of the policies championed by Macri and IMF.

While Krugman argues that Macri did not go far enough in implementing the IMF’s program, Weisbrot takes the view that the program was fundamentally flawed from the start.

“The macroeconomic policies prescribed in this program are not worth the risks and human costs that they introduce,” Weisbrot and his colleague, Lara Merling, wrote in a December analysis, noting the “increased suffering and hardship” for millions of Argentinians caused by sharp budget cuts.

While the markets reacted poorly to Fernadez’s electoral success, Weisbrot does not see cause for alarm. In an August op-ed for The New York Times, he notes that under prior left-wing governments, poverty declined dramatically GDP per person significantly as the state implemented social programs that improved the lives of ordinary Argentinians.

“By comparison, poverty has increased significantly, income per person has fallen, and unemployment has increased during Mr. Macri’s term,” he said.

Tarnished Image

Other experts offered a wide range of critiques of the IMF’s actions.

“The decision to grant Argentina a loan of this size was much more political than technical. The fund is like that; it’s always been like that,” economist Monica de Bolle told AFP.

Macri’s “incremental” strategy involved “a lot of risk,” which the IMF recognized, said de Bolle, who worked as an economist for the lender during Argentina’s 2002 crisis.

“The IMF’s image suffered from this excess of optimism,” said the economist, now a researcher at the Peterson Institute for International Economics in Washington.

Jayati Ghosh, an economics professor at Jawaharlal Nehru University in New Delhi, agreed that the fund has “a long history of policy mistakes.”

But Claudio Loser, an Argentine economist who served as the head of IMF’s Western Hemisphere department from 1994 to 2002, played down the fund’s responsibility for the country’s failings.

He blamed Macri for policy mistakes, particularly at the start of his term, saying he should have reached out to the IMF at the end of 2017 instead of waiting until last year.

Loser told AFP however that while the IMF was “clearly not” responsible for the latest crisis, it had loaned Argentina too much because “the management of the IMF wanted to have a big success.”

“Unfortunately, the Argentines more than the IMF failed because they never accept the idea that adjustment is inevitable and takes time,” he said, claiming the country’s political opposition and trade unions are “skilled at destabilizing governments.”

‘Head Over Heels’ for Macri

Benjamin Gedan, the director of the Wilson Center’s Argentina project, said that “some of Macri’s errors were foreseeable, such as borrowing so massively, and in dollars.”

But the “deeper and quicker” budget cuts that some called for could have provoked a political crisis.

“The IMF seems to have overlooked doubts about Argentina’s debt repayment capacity because key board members, including the United States, had fallen head over heels for Macri,” he said.

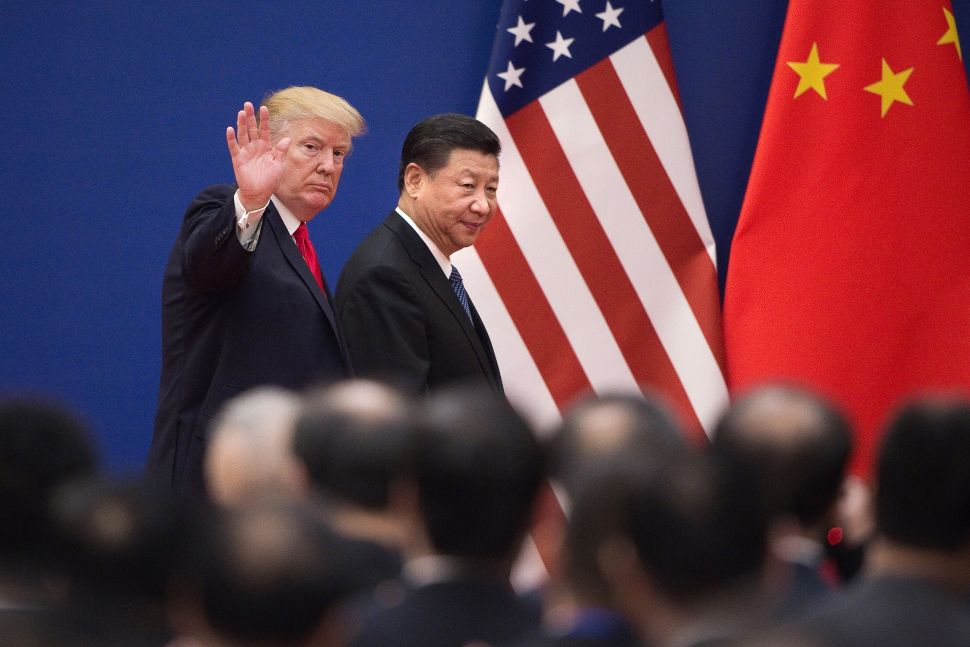

Macri, who came to power after promising to change the protectionist policies of his predecessor Cristina Kirchner (2007-2015), won over U.S. President Donald Trump‘s representative in the institution, as well as IMF chief Christine Lagarde herself.

Lagarde, who leaves the IMF this week to take over leadership of the European Central Bank later this year, admitted in June that the fund had “underestimated” the severity of Argentina’s “incredibly complicated” economic challenge.

An IMF spokesperson told AFP the fund’s focus “has been and remains on helping Argentina during these challenging times.”

More on the Subject